Professional marketers know the rule: You don’t make your money from the first sale. You make your money from the repeat business.

The vast majority of profit derived from acquiring a new customer comes in the months and years AFTER their initial purchase. But how much can (or should) you be spending to get new customers? How much is too much and how much is too little?

Customer Lifetime Value is THE way a business measures the value and opportunity related to their repeat business.

Calculate your customer lifetime value now

With your customer lifetime value in hand, you can make easier business decisions regarding sales and marketing while being confident in your future success. Download our customer lifetime value tool calculator or calculate using our online calculator and determine your CLV!

What is Customer Lifetime Value?

According to the Harvard School of Business, customer lifetime value “helps a marketing manager arrive at the dollar value associated with the long-term relationship with any given customer, revealing just how much a customer relationship is worth over a period of time.”

In short, it helps business owners and marketers decide how much money they’re willing to spend in order to acquire a new customer. So while many first time sales won’t result in a profit, they will ultimately yield a greater profit to your business in the long term.

Need help calculating your customer lifetime value or want to discuss your results?

Calculating Your CLV

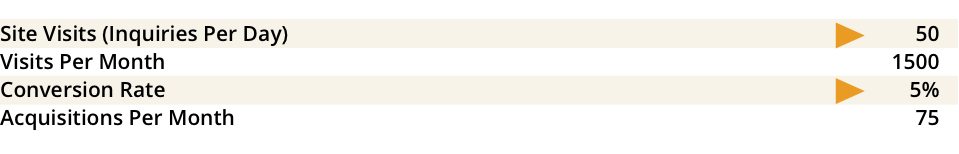

1. Site Visits & Conversion Rate:

Enter the number of visits your site gets per day and the average Conversion Rate for a given month. Assume that Conversion Rate means you’ve actually made a sale. In the provided spreadsheet, the tan fields are the fields you should enter your data into—all other fields are calculated automatically.

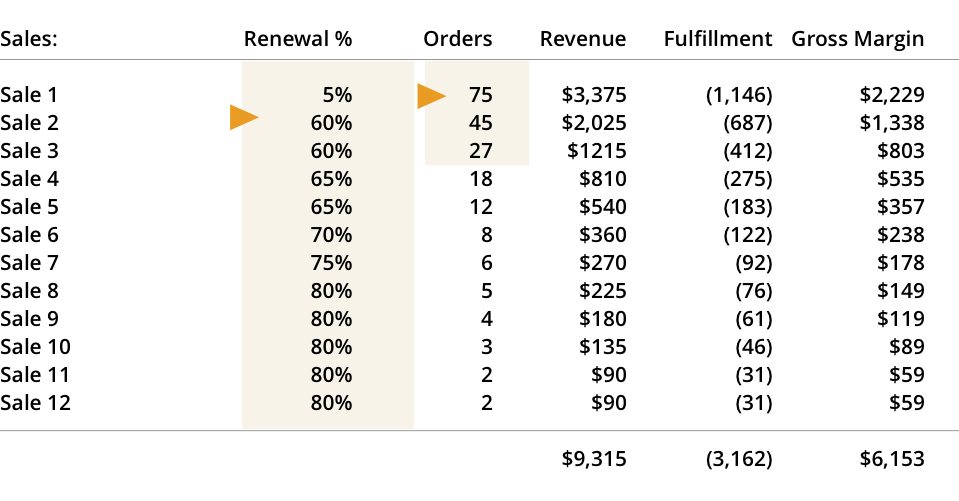

2. Enter Your Renewal Percentages:

We provided 12 slots for repeat sales, but you may choose to increase or decrease this once you get a feel for how the spreadsheet works. Use these fields to estimate your renewal / repurchase rates for the pool of customers.

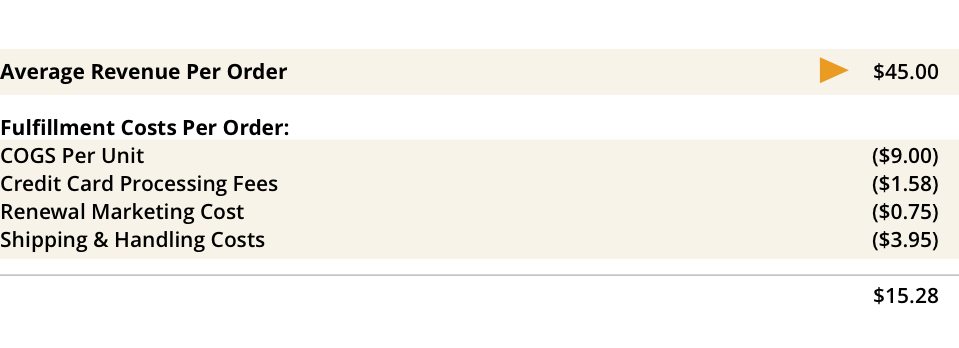

3. Average Revenue & Fulfillment Costs:

Enter the variables for how much revenue you get and now much it costs you to fulfill each order.

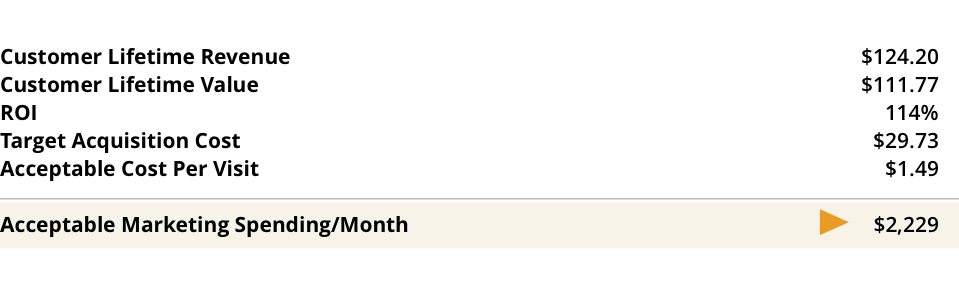

4. Review Customer Lifetime Value & Target Spending:

Here you can see what your CLTV and ROI Percentages would be under the given scenario.